Order Blocks is a Powerful strategy in forex trading. In this Lesson I Will discuss About Order block forex trading.

Order Blocks:

What are Order Blocks? An Order Block is the final candle before an impulsive move that leads to a break in market structure. This basically means the most recent higher high gets taken out. Or the most recent lower low gets taken out. If a higher high or lower low is not made, and price proceeds towards the up/downside, then that final candle is not considered a valid Order Block. Price must break structure to be valid.

When we take a look at supply & demand, or bullish & bearish Order Blocks, the newer is usually the better. So what i mean by this is an untested supply or demand zone, or an untested order block is more likely to give us the expected reaction that we are looking for with price, as opposed to one that price has already come into before, to mitigate.

A quick rule of thumb: The 50% equilibrium point of a particular Order Block can act as a strong level where price likes to mitigate to, before continuing in that overall direction. What I have found to be true in my own testing is, if price comes up to fill 50% of the Order Block, then we can now classify that Order Block as mitigated, and completed, and for no reason to look at that area for future interest.

The timeframe your trading, and the market structure you are currently seeing is important, meaning: Are you seeing bullish market structure? If you are, then it would make more sense to be looking for long trades at demand zones and bullish Order Blocks, rather than looking for supply zones and shorting bearish Order Blocks. Obviously the same concepts apply it you are seeing bearish market structure.

Usually speaking, the higher the timeframe, the more significance the zones, or Order Blocks will have. Meaning they can be more realiable. Example: Taking a long from a 4 hour Order Block that led to a £5000+ move, could give more of a reaction from taking a long from a 15 minute Order Block that led to only a £500 move in price.

Bullish Order Blocks:

A bullish Order Block is the last down candle before a bullish, impulsive move to the upside that breaks structure. We will see large momentum to the upside, which usually leaves behind some price imbalance.

Order Blocks are just a fancy word for supply and demand levels, where large institutions have placed big orders at these areas in the market. The theory, is that price will eventually gravitate back towards these Order Blocks, to re-balance price; fill any liquidity, and for more orders to be placed.

Once we get these Order Blocks form, they normally leaves behind imbalance. So price needs to return back and make price efficient before continuing up.

We can identify a clear entry, and stop-loss with Order Blocks. Entry at the top of the Order Block with a stop loss at, or just below the Order Block.

Bearish Order Blocks:

A bearish Order Block is the last up candle before a bearish, impulsive move to the downside that breaks structure. We will see large momentum to the downside, which usually leaves behind some price imbalance.

Large institutions have placed big orders at these areas in the market. The theory, is that price will eventually gravitate back towards these Order Blocks, to re-balance price; fill any liquidity, and for more orders to be placed.

Once we get these Order Blocks form, they normally leaves behind imbalance. So price needs to return back and make price efficient before continuing down.

We can identify a clear entry, and stop-loss with Order Blocks. Entry at the top of the Order Block with a stop loss at, or just below the Order Block.

Lower Timeframe Order Block Refinement:

So one thing that we can do with Order Blocks, is we can actually refine them down when possible. So it's important for us to note where the momentum has come into the market ie: where the institutions have got in. Because essentially what happens is, where ever that momentum started, price will usually come back to that area, and then we can see price continue its move.

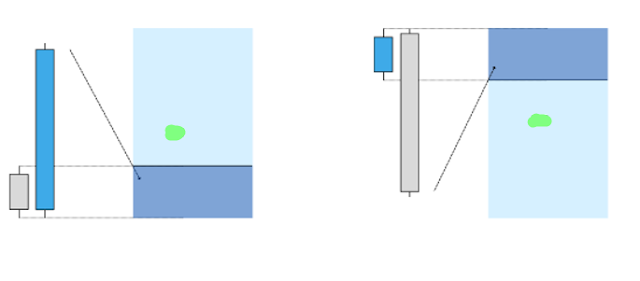

The reason why refining our Order Blocks down is beneficial to us is because it tightens our area of interest, meaning we can get in more precise with a tighter stop loss, and usually decrease our drawdown on our trade. It will also give us the chance to increase our risk to reward ration on our trade so we can get a better return. The examples below show an Order Block refinement. So you can see the Bullish Order Block gave us a last down candle followed by a small bullish candle which did not engulf the Order Block, or show us any momentum towards the upside. It was in fact the candle after that showed the momentum. So we can refine our Order Block down to this bullish candle. We have the exact same example with the Bearish Order Block on the right.

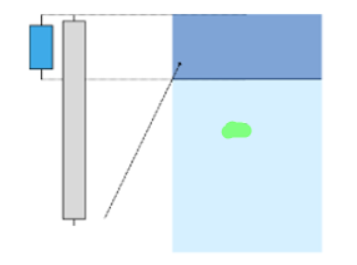

This is what we could see when we drop down to a lower timeframe. Take a look at how we are able to refine our Order Block zone and decrease our area.

Order Block Refinement:

So one thing that we can do with Order Blocks, is we can actually refine them down if possible. So it's important for us to note where the large momentum has come into the market ie: where the institutions have got in. Because essentially what happens is, where ever that momentum started, price will need to come back to that area, and then we can see price continue its move.

The reason why refining our Order Blocks down is beneficial to us is because it tightens our area of interest, meaning we can get in more precise with a tighter stop loss, and usually decrease our drawdown on our trade. It will also give us the chance to increase our risk to reward ration on our trade so we can get a better return. The examples below show an Order Block refinement. So you can see the Bullish Order Block gave us a last down move, followed by a small bullish candle which did not engulf the Order Block, or show us any momentum towards the upside. It was in fact the candle after that showed the momentum. So we can refine our Order Block down to this bullish candle. We have the exact same example with the Bearish Order Block on the right.

When we have a similar scenario like the example below, where we have two areas of interest to buy from. The lower one would be considered more high probability (dependant on the trade) because of liquidity that needs to be cleared first. What we will usually see if price comes down past the first order block, to see the liquidity before price is actually able to move to the upside. when we can see clear liquidity areas, then it is important to know that price is likely to target there before we see a committed move to the upside.

Quick tip: the markets will ALWAYS target the liquidity. Don't be the liquidity.

Previews I Cover:

Thanks Everyone