This post i cover Liquidity and Manipulation concept in forex Trading.

Liquidity and Manipulation:

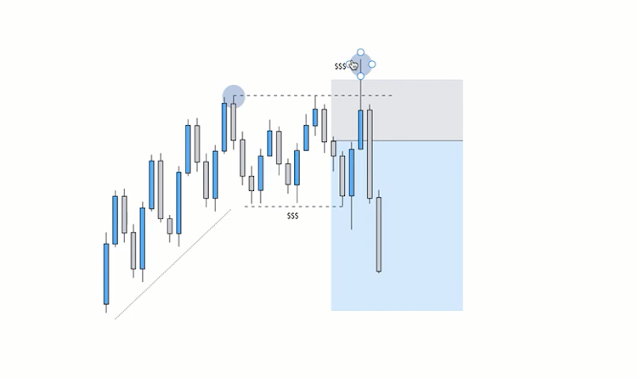

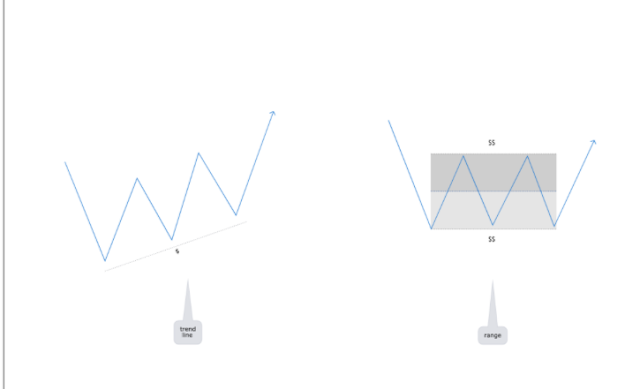

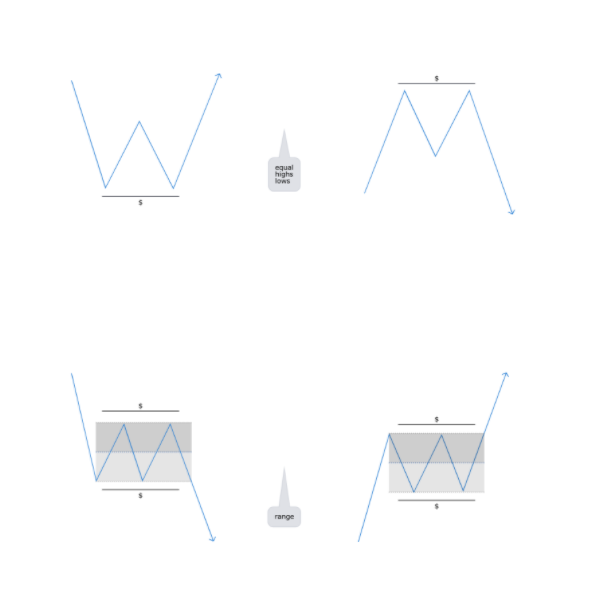

The markets need to generate liquidity in order to move up or down. If liquidity isn't already there, then it will be created. When new traders come to hear about forex and what to learn about it, one of the first things they do is search about it on YouTube. What's the first thing that comes up? Retail basics like; support and resistance; chart patterns which are extremely popular in the industry, ect. 4/5 years ago when i got into trading, support and resistance and indicators what was i was being taught. The strategy was based off of moving averages and the stochastic, which looking back at now is quite funny. What some brokers also do is they offer free education for their clients once you start trading with them. This education will usually be based around retail methods like support & resistance. Why is this? It's simple. They want to generate liquidity into the markets. These retail methods are not unknown to large institutions, and people with large interests. Of course they aren't. All this information is out there for free. So if all of this information is availble for free, then don't you think it's wise to assume that these people with huge amounts of money are going to use it against the retail traders, in order to manipulate the markets? I want everyone to be aware that these markets are very much rigged, and designed for you to lose long term. It's all manipulated, but as long as we know this, we have an advantage to work around it, and stay away from the retail side of things. The majority of us have learnt all these retail methods, so let's try and rewire our brains and do what the others aren't. When we dig deep into chart patterns like the double top/double bottom, or bull/bear flags, which retail traders absolutely love. They are all manipulated and they only really work when you know what your doing. Traders are taught to sell at double tops, or buy at double bottoms. If we know this, then what does that mean? It means that there is lots of liquidity above/below these areas. So that is why we know a double top as equal highs, and a double bottom as equal lows. We expect price to be manipulated at and around these areas. All you need to do is go and look at the data, It's all there. Once we see large moves up, sell side liquidity will usually need to be generated before hand. The same goes for when we see large down moves, buy side liquidity will usually need to be generated or taken out.